WORD PROBLEMS INVOLVING DEPRECIATION

Subscribe to our ▶️ YouTube channel 🔴 for the latest videos, updates, and tips.

What is depreciation ?

Depreciation describes how good diminish in value over time.

To find the future value after depreciation, we have to use the formula given below.

Fv = Pv (1 - i)n

where, Fv is the future value after n time periods

Pv is the original purchase price or present value

i is the depreciation rate per period as a decimal

n is the number of periods.

Problem 1 :

A car was purchased for $32500 and depreciated annually by 16%. Find its value after 10 years.

Solution:

Fv = Pv (1 - i)n

= 32500 (1 - 0.16)10

= 32500 × (0.8410)

= 32500 × 0.1749

= $5684.29

Problem 2 :

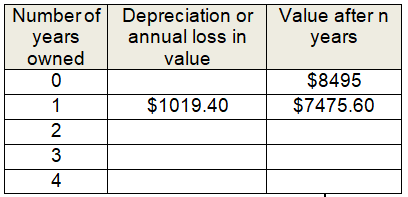

A motorbike was purchased for $8495 in July 2001 and depreciates at 12% each year. Copy and complete the following table:

a. For taxation purposes, the motorbike is essential for making an income (as it is used exclusively in a delivery service). Annual loss in value (called depreciation) can be used as a tax deduction. How much can be 'claimed' during the 4th year of use?

b. Find the value of the motorbike at the end of the 8th year.

c. What is the significance of F10 - F9?

Solution:

Fv = Pv (1 - i)n

Number of years owned = 1

Depreciation or annual loss in value = 0.12 × 8495

= $1019.40

F1 = 8495 (1 - 0.12)1

= 8495 (0.88)

= $7475.60

Number of years owned = 2

Depreciation or annual loss in value = 0.12 × 7475.60

= $897.07

F2 = 8495 (1 - 0.12)2

= 8495 (0.88)2

= $6578.53

Number of years owned = 3

Depreciation or annual loss in value = 0.12 × 6578.53

= $ 789.42

F3 = 8495 (1 - 0.12)3

= 8495 (0.88)3

= $5789.11

Number of years owned = 4

Depreciation or annual loss in value = 0.12 × 5789.11

= $694.69

F4 = 8495 (1 - 0.12)4

= 8495 (0.88)4

= $5094.42

a.

= $1019.40 + $897.07 + $789.42 + $694.69

= $3400.58

b.

Fv = Pv (1 - i)n

P = 8495, n = 8

Fv = 8495 (1 - 0.12)8

= 8495 (0.88)8

= 8495 (0.3596)

= 3055.10

c.

Fv = Pv (1 - i)n

F10 = 8495 (1 - 0.12)10

= 8495 (0.88)10

= 8495 (0.2785)

F10 = 2365.86

F9 = 8495 (1 - 0.12)9

= 8495 (0.88)9

= 8495 (0.3164)

F9 = 2688.48

Problem 3 :

a. If buy a car for $38500 and keep it for 3 years, what will its value be at the end of that period given that its annual depreciation rate is 20% ?

b. By how much did it depreciate?

Solution:

a.

Given, Pv = 38500

i = 20% = 0.2

n = 3

Fv = Pv (1 - i)n

Fv = 38500 (1 - 0.2)3

= 38500 (0.8)3

= 38500 (0.512)

= $19712

b.

Depreciate = $38500 - $19712

= $18788

Problem 4 :

A cabin cruiser was bought for $120000 in April 1998 and was sold for $45000 in April 2006. At what average annual rate of depreciation did the boat lose its value?

Solution:

Given, Pv = $120000

Fv = $45000

n = 8

Fv = Pv (1 - i)n

Problem 5 :

A small jet aeroplane was purchased for 3.4 million dollars in January 1998 and was sold for 2.35 million dollars in July 2005. What was its average annual rate of depreciation over this peroid?

Solution:

Given, Pv = 3.4 million dollars

Fv = 2.35 million dollars

n = 7

Fv = Pv (1 - i)n

2.35 = 3.4(1 - i)n

2.35/3.4 = (1 - i)7

0.69 = (1 - i)7

log 0.69 = log(1 - i)7

log 0.69 = 7 log(1 - i)

log 0.69/7 = log (1 - i)

-0.0230 = log(1 - i)

0.9523 = 1 - i

i = 1 - 0.9487

i = 0.0477

Rate of depreciation = 0.0477 x 100%

= 4.77 %

Approximately 4.8%.

Subscribe to our ▶️ YouTube channel 🔴 for the latest videos, updates, and tips.

Recent Articles

-

Finding Range of Values Inequality Problems

May 21, 24 08:51 PM

Finding Range of Values Inequality Problems -

Solving Two Step Inequality Word Problems

May 21, 24 08:51 AM

Solving Two Step Inequality Word Problems -

Exponential Function Context and Data Modeling

May 20, 24 10:45 PM

Exponential Function Context and Data Modeling